A business valuation is a general method of assessing the economic worth of an entire unit of a company or enterprise. Company valuation may be used to assess a company’s fair value for a number of purposes.

Those purposes include market interest, partner ownership establishment, taxes, and even divorce proceedings. Owners also turn to qualified business evaluators for an unbiased assessment of the company’s interest.

In this blog, you will learn more about business valuation, how it works, and how to increase this for your company and business!

Overview of Business Valuation

In the corporate finance industry, the topic of company valuation is a frequent topic of conversation. Company valuation is usually conducted when a corporation wants to sell all or part of its activities or to combine or acquire another company.

Business valuation is the method of assessing a business’s current value, using objective criteria, and analyzing all aspects of the business.

An overview of the management of the company, its financial structure, its potential prospects for earnings, or the market value of its assets may include a business valuation. The methods used for valuation can vary.

The Internal Revenue Service (IRS) requires a company to be measured on the basis of its fair market value. Many tax-related activities like the selling, purchase, or donation of a company’s shares may be charged depending on the value.

Approaches to Help You Increase Business Valuation

Approach 1: Cost Approach

The cost method is a simple approach to valuation. The basic hypothesis is the idea that the price a buyer should pay for a piece of property should be equal to the cost of building an equivalent property.

Meaning, the value of an enterprise is the total value of its physical assets (property).

Approach 2: Asset-Based

Truly, an asset-based business valuation will sum up all of the company’s investments. Business valuations of properties can be achieved in one of two ways.

- A forward-looking asset-based strategy looks at the balance sheet of the company, lists the total assets of the firm, and subtracts the total liabilities. This is called the book profit, as well.

- A method based on liquidation assets calculates the liquidation value or net cash that would be obtained if all assets were sold and liabilities were paid off.

Approach 3: Income Approach

The valuation income method takes different forms, and each form measures overall value using a function of current earnings and expected earnings – or revenue.

The asset approach can’t easily measure the value of intangible or tangible assets used, which is why the approach to revenue is useful.

An evaluator values the company as a whole, based on expected cash flows and net income. The “discounted cash flow” approach is most widely used.

The Discounted Cash Flow (DCF) formula measures value after operating costs, taxation, and interest payments as the present value of potential cash flows of a company.

As much as the value of a stock interest is equal to the present value of all potential dividends, so a firm’s value is equal to the present value of its projected cash flow.

Analysts first assess the discount rate for the company, or WACC, then estimate the current period’s earnings and cash flow.

The How-Tos: Increase Business Valuation

Emphasis on EBITDA

Earnings before interest, tax, depreciation, and amortization (EBITDA), shows an enterprise’s operational performance by ignoring the effect of financing on earnings.

By some point, another salesman, analyst, factory worker, or software product will no longer have a positive effect on profits, so optimizing EBITDA is the technique of seeking the optimum combination of equipment, staff, analysis, so marketing to maximize income.

Minimize Risks

Risk is an important pricing aspect of all investments. Even a business with a stellar-looking balance sheet and income statement looks like a risky investment unless investors see room for success.

There are countless factors that could contribute to the risk. In short, if investors have reason to doubt a company’s future success, they’ll. The value would then go down.

Know the Industry

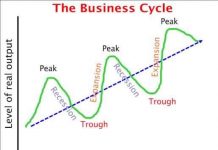

A valuation problem is for all values to be subjective. Too much emphasis on earnings or cash flow irrespective of industry and their place in the economic life cycle can lead to incorrect valuation conclusions.

Conclusion

Business valuation is complicated since so many unknowns exist. The cost method can identify an exact market value on many physical assets but struggles to value intellectual property and other immaterial assets.

Each sector is so special that it is not feasible to define an objective valuation recipe. However, owners who pay attention to sales growth and EBITDA, risk reduction, and key indicators will be more likely to understand their expected value increases.