Overhead expenses are business costs that are not directly related to the product or service of the business. This is important for purposes of budgeting but also for calculating how much a company needs to charge.

If you take into account your overhead costs, you can price your goods or services so that they take into account those overheads. And if you do that, you can turn a profit.

In short, overhead is any cost incurred in maintaining the company despite not being directly connected to a specific product or service. This article will help you determine why it’s essential to control these costs.

Types of Overhead

Fixed

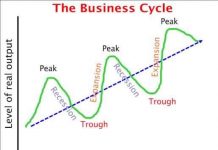

In general, the operating costs are fixed. Which means they do not change dramatically within the immediate future.

Costs include rent, mortgage payments, annual compensation, pensions, property taxes, government fees, certain utilities, asset depreciation, and more.

Variable

Those costs can differ within the immediate future. Definitions of these costs include repair of facilities, marketing, legal expenses, tools, consulting services, transportation, office supplies, and more.

Semi-Variable

Many operating costs can also be semi-variable, meaning a company may have to pay these costs in varying amounts regardless of the revenue. Some examples include car use, extra hourly pay, salesperson fee, and more.

What is the Importance of Tracking These Expenses?

These costs should be tracked and regulated since they are not directly proportional to revenue. And, unless caution is taken, these expenses may become a greater share of overall spending, and eat up net income and profits.

Considering these costs also assists a firm in setting rates. Someone can club labor costs with the direct cost of understanding the total expenditures a company incurred.

Such costs are also important for reaching net profit or the bottom line. To achieve net income, all costs, including depreciation, must be subtracted from gross profit.

Should a Business Cut Down on Overhead Costs?

In order to optimize income, a company must always aim to reduce these costs. Raw material and labor are vital to production, so a business can not cut down there.

Cutting down on overhead can allow a company to be more competitive. For example, a company will regularly carry out a review of its staff count.

This will examine whether or not the current level of staffing is needed for current sales. When not, the headcount may be reduced, and that will raise the bottom line.

Additionally, cutting the labor costs while a corporation is in a downturn is one of the best ways to bring the company back on the growth track.

How to Cut Down on Overhead Costs

Minor steps will have a great impact on your expenses. For starters, turn over the communications company programs. Internal messaging services like Skype or Google Voice may substantially reduce your phone bill.

Make sure the analysis is comprehensive and choose the alternative that best suits your needs.

Start Small: Communication Expenses

Be cost-efficient when it comes to travel. Travel expenses easily eat up a budget, especially for smaller organizations. Try conducting teleconferences rather than bringing in off-site workers to reduce those expenses.

Travel Smart

To save, book travel months in advance, whenever possible.

Negotiate leases, as rent is often one of the highest costs for businesses. Thankfully, by negotiating with your landlord or moving to a less costly space, costs can be cut.

Save Costs on Utilities

Be mindful of the cost of services. Electricity and other energy costs can easily add up, but there are also ways to cut back.

LED bulbs consume between 70 and 90 percent less energy than incandescent bulbs. Moreover, devices that are plugged into outlets use energy even though they are not working.

Consider plugging computers and other devices into power strips, then switching them off completely at the end of the working day.

Control Admin Costs

For the administration, unfortunately, in a downturn in the industry, the best way to minimize operating costs is to slash jobs, which is both difficult for workers and management but also necessary to ensure company survival.

This can also be avoided if workers are able to share their jobs, move to part-time employment, or take unpaid leave.

In a fluctuating market climate, the use of contract workers rather than recruiting employees is another way to handle your personnel requirements and reduce the operating costs.

Conclusion

Bonus tip: You need to measure the overhead costs before you can accurately report your overhead expenses. You can also measure overhead rates for different time periods after you determine the overall overhead costs.

The overhead rate compares your operating costs to your earnings. Try out these tips to find savings in your business right away.